2 Under $1 Cryptocurrencies To Buy For Struggling Crypto Portfolios

2 Under $1 Cryptocurrencies To Buy For Struggling Crypto Portfolios Investing in cryptocurrencies can be a rollercoaster ride, especially for those with limited budgets or portfolios that have taken a hit. Finding affordable yet promising crypto assets is a challenge many investors face. In this blog, we will explore two cryptocurrencies priced under $1 that could potentially revive struggling crypto portfolios. Dogecoin (DOGE): The Meme Coin with Real Potential Cryptocurrencies Why Dogecoin? Dogecoin started as a joke, inspired by the popular “Doge” meme, but it has since grown into one of the most recognized cryptocurrencies. Despite its humorous beginnings, Dogecoin boasts several features that make it an attractive investment: Current Price and Market Potential At the time of writing, Dogecoin is priced well under $1, making it accessible for investors with limited funds. Given its established presence and potential for future growth, Dogecoin could be a viable option for those looking to diversify their crypto portfolios without breaking the bank. VeChain (VET): Revolutionizing Supply Chain Management Why VeChain? VeChain is a blockchain platform designed to enhance supply chain management and business processes. By utilizing distributed ledger technology, VeChain aims to streamline and secure the flow of information between businesses, thereby improving efficiency and reducing fraud. Here’s why VeChain stands out: Current Price and Market Potential VeChain is currently trading below $1, making it an attractive option for budget-conscious investors. Its focus on real-world applications and established partnerships suggest a strong potential for future growth, making it a worthy consideration for enhancing a struggling crypto portfolio. Conclusion: Balancing Risk and Reward Investing in cryptocurrencies, especially those priced under $1, comes with its own set of risks and rewards. Dogecoin and VeChain offer unique advantages that could help rejuvenate a struggling crypto portfolio. As with any investment, it’s crucial to conduct thorough research and consider your own risk tolerance before diving in.

Hacked Japanese Crypto Exchange DMM Bitcoin Plans Massive BTC Purchase

Hacked Japanese Crypto Exchange DMM Bitcoin Plans Massive BTC Purchase In a bold move to restore confidence and strengthen its market position, the recently hacked Japanese cryptocurrency exchange, DMM Bitcoin, has announced plans for a significant purchase of Bitcoin (BTC). This strategic initiative aims to demonstrate the exchange’s resilience and commitment to its users following a security breach that resulted in considerable financial losses. The Security Breach DMM DMM Bitcoin, one of Japan’s prominent cryptocurrency exchanges, experienced a sophisticated cyber attack that compromised the accounts of numerous users and led to the theft of substantial amounts of Bitcoin and other digital assets. The breach highlighted vulnerabilities within the exchange’s security systems, prompting immediate action to fortify their defenses and compensate affected users. Recovery and Strategic BTC Purchase In response to the hack, DMM Bitcoin is not only enhancing its security protocols but also making a substantial BTC purchase to bolster its reserves. This move is seen as part of a broader crypto consolidation strategy aimed at stabilizing the exchange’s operations and regaining the trust of its clientele. By increasing its Bitcoin holdings, DMM Bitcoin intends to signal its long-term commitment to the cryptocurrency market and its ability to recover and thrive despite setbacks. Enhancing Security and Trust The exchange has taken several measures to improve its security framework, including comprehensive cryptocurrency audits to ensure all systems and processes meet the highest standards. These audits are crucial for identifying potential vulnerabilities and implementing robust safeguards to protect user assets. Additionally, DMM Bitcoin is investing in advanced crypto bookkeeping systems to maintain transparent and accurate records of all transactions. This transparency is essential for rebuilding trust with users and demonstrating the exchange’s dedication to accountability and reliability. Supporting Users with Tools and Resources To assist users affected by the hack and to foster a secure trading environment, DMM Bitcoin is offering a range of support tools. These include a comprehensive Crypto Tax Calculator and Crypto Tax Software, designed to help users accurately report their cryptocurrency transactions and comply with regulatory requirements. By providing these resources, the exchange aims to simplify the complexities of crypto tax compliance and enhance the overall user experience. Moving Forward DMM Bitcoin’s decisive actions following the security breach underline its resilience and proactive approach to crisis management. The massive BTC purchase is a clear statement of confidence in the future of cryptocurrency and the exchange’s role within it. As DMM Bitcoin continues to implement enhanced security measures and provide valuable resources for its users, it is poised to emerge stronger and more reliable than ever. In conclusion, DMM Bitcoin’s response to the hack demonstrates a comprehensive strategy that includes strengthening security, enhancing transparency through improved crypto bookkeeping, conducting thorough cryptocurrency audits, and supporting users with practical tools like the Crypto Tax Calculator and Crypto Tax Software. These efforts collectively aim to restore trust, ensure regulatory compliance, and solidify the exchange’s position in the evolving crypto market.

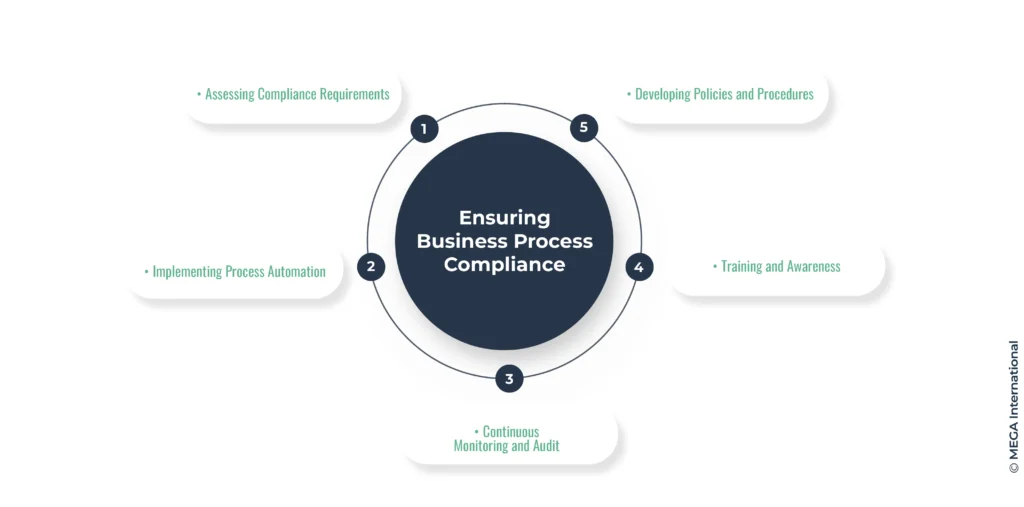

Enhancing Organizational Integrity: A Detailed Guide to Compliance Check Processes In today’s complex business environment, maintaining organizational integrity is paramount. Ensuring that your organization adheres to regulatory standards and ethical practices requires a robust compliance check process. This guide will provide an in-depth look at compliance check processes, their importance, and how to effectively implement them in your organization. Introduction to Compliance Check Processes A compliance check is a systematic review of an organization’s adherence to regulatory requirements, internal policies, and industry standards. This process helps identify any discrepancies or violations, ensuring that the organization operates within legal and ethical boundaries. Importance of Compliance Checks Compliance checks are crucial for several reasons: Define Compliance Requirements The first step in a compliance check process is to clearly define the compliance requirements. This includes understanding relevant laws, regulations, and industry standards that apply to your organization. Develop Compliance Policies and Procedures Once the requirements are defined, develop comprehensive compliance policies and procedures. These should outline the expectations for employees and provide clear guidelines for maintaining compliance. Train Employees Training is essential to ensure that all employees understand the compliance policies and procedures. Regular training sessions and updates can help keep everyone informed about the latest regulatory changes and organizational expectations. Monitor and Audit Continuous monitoring and regular audits are necessary to ensure ongoing compliance. This involves tracking key performance indicators (KPIs) and conducting periodic reviews to identify any areas of non-compliance. Address Non-Compliance When instances of non-compliance are identified, it is crucial to address them promptly. This can involve corrective actions, additional training, or revising policies and procedures to prevent future issues. Maintaining thorough documentation and reporting is vital for demonstrating compliance efforts. This includes keeping records of compliance checks, audit results, training sessions, and any corrective actions taken. Best Practices for Effective Compliance Check Processes Promote a culture where compliance is valued and prioritized. Leadership should set an example by adhering to compliance standards and encouraging employees to do the same. Utilize Technology Leverage technology to streamline compliance check processes. Compliance management software can automate monitoring, reporting, and documentation tasks, making the process more efficient and accurate. Keywords: compliance management software, technology, automation, compliance efficiency Regularly Review and Update Compliance Programs Compliance requirements and regulations can change frequently. Regularly review and update your compliance programs to ensure they remain current and effective. Conclusion Implementing a thorough compliance check process is essential for maintaining organizational integrity. By defining clear compliance requirements, developing robust policies and procedures, training employees, and continuously monitoring and auditing, organizations can effectively manage compliance and mitigate risks. Embracing best practices and utilizing technology further enhances the efficiency and effectiveness of these processes, ensuring that your organization remains compliant and operates with integrity. By following these guidelines, organizations can not only protect themselves from legal repercussions but also build a reputation of trust and reliability in their industry.

Navigating the Complex World of NFT Accounting: Essential Tips and Services

Navigating the Complex World of NFT Accounting: Essential Tips and Services As the Complex World world of non-fungible tokens (NFTs) continues to expand, so does the need for proper accounting practices to manage these unique digital assets. Whether you’re an artist, collector, or investor, understanding the intricacies of NFT accounting is essential for maintaining accurate records and ensuring compliance with tax regulations. In this article, we’ll explore essential tips and services for navigating the complex world of NFT accounting, including the role of NFT Accounting Service providers and other related services such as Crypto Tax Advisory Service. Understanding NFT Accounting NFTs represent digital assets that are unique and indivisible, making their accounting treatment distinct from traditional cryptocurrencies like Bitcoin or Ethereum. Proper NFT accounting involves tracking acquisitions, sales, royalties, and other transactions associated with these digital assets, while ensuring compliance with accounting standards and tax regulations. Essential Tips for NFT Accounting When managing NFTs, consider the following tips to ensure accurate and compliant accounting: Role of NFT Accounting Service Providers Professional NFT accounting service providers offer specialized expertise and solutions to help individuals and businesses manage their NFT portfolios effectively. Some key services include: Related Services In addition to NFT accounting, individuals and businesses may benefit from related services such as Crypto CFO Service and Crypto Exchange Accounting Service: Conclusion Navigating the complex world of NFT accounting requires specialized knowledge and expertise to ensure accurate record-keeping, compliance with tax regulations, and effective management of digital assets. By leveraging the services of professional NFT accounting providers and related services such as Tax Mitigation Solutions, Crypto Compliance Check Service, and NFT Accounting Service, individuals and businesses can streamline their operations, mitigate risks, and maximize the value of their NFT portfolios. With proper accounting practices in place, stakeholders can confidently navigate the evolving landscape of NFTs and capitalize on the opportunities presented by this innovative asset class.

Comprehensive Crypto Compliance Checks: Ensuring Financial Security and Legal Adherence

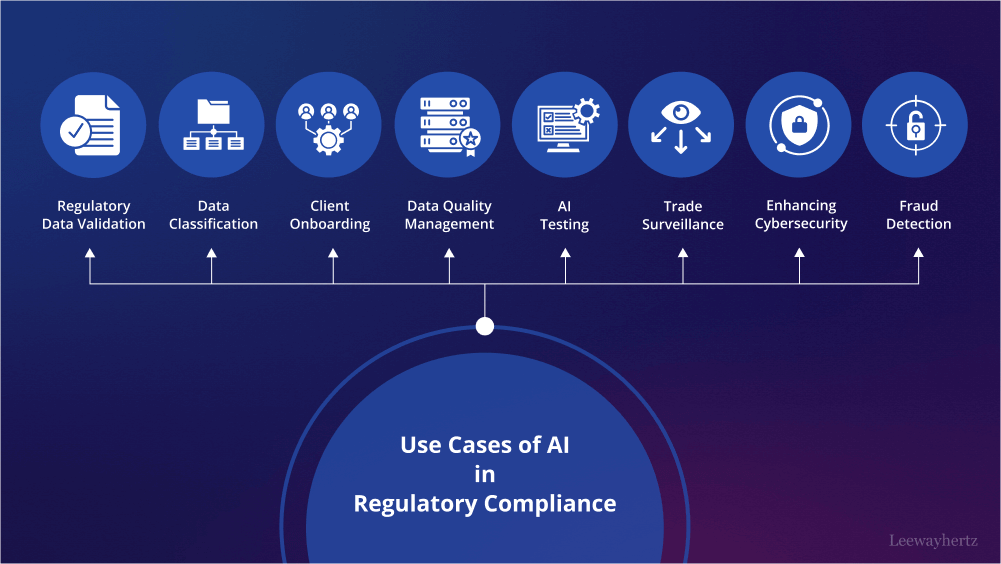

Comprehensive Crypto Compliance Checks: Ensuring Financial Security and Legal Adherence With the rapid growth of the cryptocurrency Comprehensive Crypto Compliance Checks: Ensuring Financial Security and Legal Adherence market, regulatory scrutiny has intensified, underscoring the importance of compliance for individuals and businesses operating in this space. Ensuring compliance with financial regulations and legal requirements is essential for maintaining financial security and mitigating legal risks. In this article, we’ll explore the significance of comprehensive crypto compliance checks and the role of various services, including Crypto Compliance Check Service, Crypto Tax Advisory Service, and others, in achieving this goal. Understanding Crypto Compliance Crypto compliance refers to the adherence to regulatory requirements, financial laws, and industry standards governing cryptocurrency transactions and activities. Compliance measures aim to prevent illicit activities such as money laundering, fraud, and terrorist financing, while also safeguarding investors and maintaining market integrity. Importance of Comprehensive Compliance Checks Comprehensive compliance checks are crucial for individuals and businesses involved in cryptocurrency transactions for several reasons: Role of Crypto Compliance Check Service: Professional Crypto Compliance Check Service providers offer specialized expertise and solutions to help individuals and businesses assess and enhance their compliance efforts. Some key functions of these services include: Integration with Other Services Comprehensive compliance checks often complement other services aimed at ensuring financial security and legal adherence, including: Conclusion Comprehensive crypto compliance checks are essential for individuals and businesses operating in the cryptocurrency market to ensure financial security and legal adherence. By leveraging the services of professional Crypto Compliance Check Service providers and integrating them with other related services such as Tax Mitigation Solutions, NFT Accounting Service, and Crypto Tax Advisory Service, stakeholders can enhance their compliance efforts, mitigate risks, and navigate the evolving regulatory landscape with confidence. With proactive compliance measures in place, individuals and businesses can safeguard their interests, maintain market integrity, and contribute to the sustainable growth of the cryptocurrency ecosystem.

Maximize Your Gains with Professional Crypto Tax Advisory Services

Maximize Your Gains with Professional Crypto Tax Advisory Services As the popularity of cryptocurrency Tax Advisory Services trading continues to soar, so does the complexity of navigating the tax implications associated with it. Whether you’re a seasoned investor or just dipping your toes into the world of digital assets, understanding and managing your Crypto Tax Advisory Service is essential for maximizing your gains and staying compliant with regulatory requirements. In this article, we’ll explore the benefits of enlisting the services of professional crypto tax advisors and how they can help you navigate the intricate landscape of crypto taxation while offering Tax Mitigation Solutions. The Complexity of Crypto Taxes : Cryptocurrency transactions are subject to a myriad of tax regulations and reporting requirements, making the process of calculating and filing taxes a daunting task for many investors. Factors such as capital gains, income from mining, staking rewards, and airdrops further complicate the tax landscape, requiring careful consideration and expertise to ensure accurate reporting. Benefits of Professional Crypto Tax Advisory Services : Professional crypto tax advisors offer valuable expertise and guidance to help investors navigate the complexities of crypto taxation effectively. Some key benefits include: Services Offered by Crypto Tax Advisors Crypto tax advisors offer a range of services to meet the diverse needs of investors, including: How to Choose the Right Crypto Tax Advisor When selecting a crypto tax advisor, consider the following factors: Conclusion Navigating the complexities of crypto taxation requires specialized knowledge and expertise that many investors may lack. By enlisting the services of professional crypto tax advisors, investors can maximize their gains, stay compliant with tax laws, and enjoy peace of mind knowing that their taxes are being handled by experts. With the right advisor by your side, you can navigate the intricate landscape of crypto taxation with confidence and clarity, allowing you to focus on growing your investments and achieving your financial goals.

Solana & XRP ETF Are Next After Ether, Here’s The Potential Approval Timeline

Solana & XRP ETF Are Next After Ether, Here’s The Potential Approval Timeline The recent approval of an Ethereum Exchange-Traded Fund (ETF) has sent ripples of excitement through the cryptocurrency community. As investors eagerly anticipate further ETF approvals, attention has turned to assets like Solana (SOL) and XRP, speculated to be next in line. In this exploration, we dissect the potential approval timeline for Solana and XRP ETFs, shedding light on the factors influencing regulatory decisions and market dynamics. Understanding the ETF Craze: Exchange-Traded Funds (ETFs) have emerged as a popular investment vehicle, offering exposure to diverse assets while providing liquidity and convenience to investors. The approval of a cryptocurrency ETF marks a significant milestone in mainstream adoption, opening doors for institutional and retail investors to participate in the digital asset market through traditional brokerage accounts. The Ethereum ETF Precedent: The recent approval of the Ethereum ETF in certain jurisdictions has set a precedent for other cryptocurrencies seeking ETF approval. Ethereum’s status as a leading smart contract platform and its widespread adoption in decentralized finance (DeFi) projects have bolstered its case for regulatory approval. Solana (SOL) and XRP: Potential Contenders: Solana (SOL): Solana has garnered attention for its high-performance blockchain, offering fast transaction speeds and low fees. Its growing ecosystem of decentralized applications (dApps) and strategic partnerships position it as a strong contender for ETF approval. XRP: Despite facing regulatory challenges in the past, XRP remains one of the largest cryptocurrencies by market capitalization. Ripple’s ongoing legal battles with the U.S. Securities and Exchange Commission (SEC) have cast a shadow of uncertainty over XRP’s regulatory status. However, recent developments in the case have sparked optimism among XRP proponents. Factors Influencing Approval Timeline: Regulatory Clarity: Regulatory agencies play a pivotal role in determining the fate of cryptocurrency ETFs. Clear guidelines and regulatory frameworks provide clarity for issuers and investors, facilitating the approval process.Market Demand: The growing demand for cryptocurrency investment products among institutional and retail investors could influence regulators’ decisions. A demonstrated need for diversified exposure to digital assets may expedite the approval timeline for Solana and XRP ETFs.Issuer Compliance: ETF issuers must demonstrate compliance with regulatory requirements, including robust custody solutions, market surveillance mechanisms, and investor protection measures. Meeting these standards is essential for securing regulatory approval.Potential Approval Timeline:While specific timelines for Solana and XRP ETF approvals remain speculative, several milestones may shape the process: Ongoing Regulatory Developments: Monitoring regulatory developments and legal proceedings involving Solana and XRP will provide insights into their regulatory status.Issuer Initiatives: ETF issuers may collaborate with regulators to address concerns and expedite the approval process.Market Demand: A surge in investor demand for Solana and XRP ETFs could incentivize regulators to accelerate the approval timeline. Conclusion: As the cryptocurrency market continues to evolve, the approval of ETFs for assets like Solana and XRP represents a significant step towards mainstream adoption. While regulatory hurdles and market dynamics may influence the approval timeline, the growing interest in digital asset investment products underscores the potential for widespread adoption. As investors await further developments, staying informed about regulatory changes and market trends will be key to navigating the evolving landscape of cryptocurrency ETFs.

OKX Ceases Hong Kong Operations With Crucial User Updates

OKX Ceases Hong Kong Operations With Crucial User Updates In a significant development within the cryptocurrency exchange landscape, OKX has announced the cessation of its operations in Hong Kong. This decision, with far-reaching implications for users and the broader industry, underscores the evolving regulatory environment surrounding digital asset platforms. In this article, we delve into the details of OKX’s decision, its impact on users, and the implications for the cryptocurrency ecosystem. OKX’s Cease of Operations in Hong Kong : OKX, a prominent cryptocurrency exchange known for its global presence, has made the strategic decision to cease its operations in Hong Kong. The move comes amidst increasing regulatory scrutiny and evolving compliance requirements within the region. OKX has cited regulatory considerations as the primary driver behind this decision, reflecting the exchange’s commitment to regulatory compliance and risk management. User Updates and Transition Plans : In light of OKX’s decision to cease operations in Hong Kong, the exchange has outlined comprehensive plans to ensure a smooth transition for users. Key updates and transition measures include: Implications for Users and Industry Dynamics: Conclusion : The cessation of OKX’s operations in Hong Kong marks a significant development within the cryptocurrency exchange landscape, reflecting the evolving regulatory environment and industry dynamics. As users navigate the transition process, proactive communication, adherence to regulatory requirements, and robust customer support are paramount. OKX’s strategic decision underscores the importance of regulatory compliance and risk management in fostering a sustainable and resilient cryptocurrency ecosystem.

PEPE Price Rally: Smart Trader Nabs 1200% Profit Trading Pepe Coin

PEPE Price Rally: Smart Trader Nabs 1200% Profit Trading Pepe Coin In the volatile world of cryptocurrency trading, PEPE opportunities for substantial gains often arise unexpectedly. One such recent phenomenon is the remarkable price rally of Pepe Coin, where savvy traders have witnessed an astounding 1200% surge in profits. In this guide, we delve into the intricacies of this rally, exploring the factors driving the price surge and offering insights for traders aiming to capitalize on this lucrative trend. Understanding the PEPE Price Rally: Pepe Coin, a digital asset inspired by the popular internet meme Pepe the Frog, has experienced a meteoric rise in value in recent weeks. This surge, characterized by sharp price spikes and heightened trading activity, has captured the attention of cryptocurrency enthusiasts and investors alike. Key Factors Driving the Rally PEPE: Navigating the Price Rally: Tips for Smart Traders: Conclusion: The PEPE price rally presents a compelling opportunity for traders to capitalize on the significant profit potential offered by Pepe Coin. By understanding the driving forces behind the rally and adopting a prudent trading approach, smart traders can navigate this volatile market with confidence. As with any investment, exercising caution, conducting thorough research, and staying informed are essential pillars for success in the world of cryptocurrency trading.